Greater investment from the private sector: Eight of the twenty banks' operations decreased

In July, Himalayan, Lakshmi Sunrise, Nepal Bank Limited, NIC Asia, and other banks were unable to increase their investment. Similarly, in July, Prabhu Bank, Rashtriya Commercial Bank, and Krishi Bikas Bank also saw a slowdown in their investment increase.

Just NIC Asia Bank's investment has dropped by 10.78 billion. Himalayan Bank's operations have decreased by Rs 4.64 billion, while Krishi Bikas Bank's has decreased by Rs 2.47 billion.

The most transactions were made in July by Nepal Investment Mega Bank. In July, the bank increased its investment by 8 billion 68 crores. The business of Nabil Bank has grown by 71 billion, but the investment of Global IME Bank has expanded by 5.84 billion.

Commercial banks' total credit investment increased by just 2.25 billion. Additionally, there has been a lull in the construction activity because of the wet season. However, July and August are when banks expand their credit investment because the festival is coming up. Now is the time for entrepreneurs to open LCs, grow their businesses, etc.

The interest rate has dropped to single digits after a lengthy period of time. The bank has a large amount of money that can be invested. Overall, banks' loan-to-deposit ratios (or CD ratios) have decreased to 79 percent. Nonetheless, banks' relative investment has not increased.

According to Sunil KC, president of the Nepal Bankers Association, the reason why banks' operations are not growing is because of a lack of vigor throughout the economy as a whole. "It is natural for banks' business to shrink when there is no demand for loans," he argues.

Low morale in the private sector

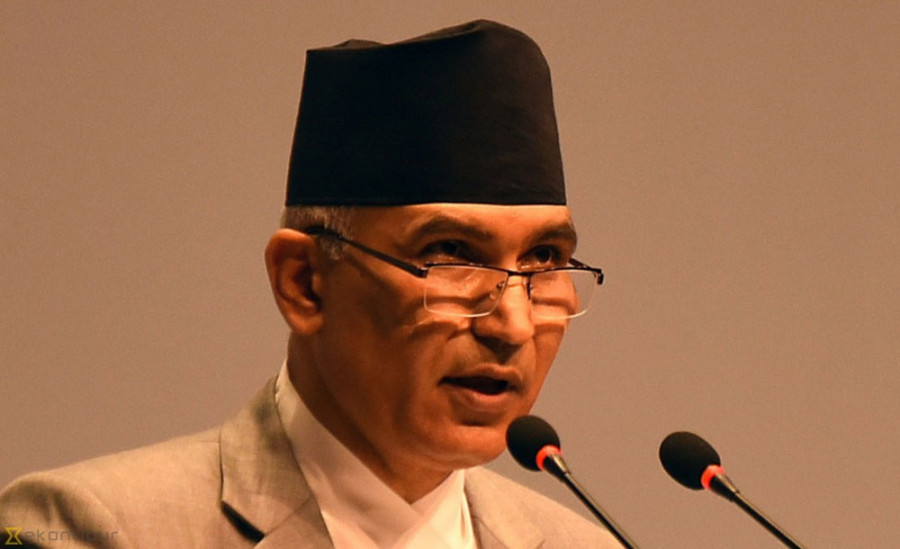

Since taking over the ministry, Bishnu Prasad Paudel, the minister of finance, has consistently urged the private sector to invest with confidence. Upon taking office on June 31st, he pledged to further government initiatives in partnership with business.

He says the same thing in public events and in talks with the private sector. At a Sunday show, Minister Poudel stated that the government supports good governance and policy stability, and he committed to ending policy changes with the minister in the near future. The present administration supports stable policies. We make arrangements such that no policy changes for a predetermined amount of time,' he said. Boost investment; security will be handled by the government.

The loan investment from July has verified that the departmental minister's request to boost the investment—made either in public or upon taking over—has not been observed in actuality. However, why aren't businesspeople prepared when the bank has a lot of investment, the interest rate has dropped, and the government is also requesting investment?

The president of the Nepal Industry Confederation, Rajesh Aggarwal, claims that there is no market for the products and that theft of consumer goods from across the border is another issue facing Nepali entrepreneurs. "The celebration is getting closer." Now is the time for suppliers and investors to increase their investments. But what should one do in the absence of demand?' he asks. "Industrialists are not enthusiastic because there is no market demand." Sectors are operating at 50% of their potential. Where should I invest and get a loan at this time?

He claims that because of open borders, declining purchasing power, young people migrating overseas, and other factors, businessmen are afraid to make investments. The middle class's consumption of food, medication, and everyday necessities has drastically dropped. "Great doubt has been caused by the declining demand for daily consumer goods," he argues.

Businessmen claim that the extreme pricing difference between Nepal and India is the reason for the rise in smuggling. Since the same things cost more in Nepal than they do in India, even retail customers are beginning to shop in international markets. A group from the Nepal Industry Confederation went to the customs crossings in Birgunj and Bhairahwa in July.

The same-team member Agarwal Wari, the head of the association, claims that during quiet times, Nepali customers frequent the Parika market in large numbers. He claims, "The government has raised the rate to increase the revenue. This situation has arisen because daily consumables are cheap in India." However, as they began purchasing and shipping throughout the nation, the state also lost out in addition to the businessmen.

Following repeated requests from the leaders of the Federation of Commerce and Industry and the Confederation of Nepal Industry to exercise vigilance in preventing theft, the Ministry of Finance established two patrol teams on Sunday to combat income leakage and illicit trade. A team from Chitwan will be sent to East Mechi, while another team will be sent to West Mahakali.

The team will apply the legal authority granted to tax and customs officers, according to Ministry of Finance spokesman Mahesh Bhattarai. Similarly, it will interact with the leakage control authorities and obtain assistance as required with the aid of the Internal Revenue Office and the Customs Office.

A fast patrol inspection team would be established to manage revenue leakage, according to the Ministry of Finance's 100-day action plan. Industry leaders have applauded the government's decision.

"It is positive that a team has been formed to control theft and revenue leakage," says Federation President Chandra Prasad Dhakal. In accordance with the action plan, the government should now set up a high-level panel to advise changes to the economic sector. He claimed that since the proposal committee is capable of resolving economic issues, it is imperative to raise industrialists' spirits.