The interest rate falls in tandem with the decline in banks' fixed deposit share.

With the reduction of interest rates by banks and other financial institutions, the percentage of term deposits is also declining. Banks have lowered interest rates and placed more of an emphasis on regular deposits than term deposits due to the accessibility of liquidity.

As to Nepal Rastra Bank's data, banks and financial institutions received deposits amounting to 64 trillion 45 billion rupees until July of the current financial year (FY) 2081/82. Of these deposits, 57.5 percent had reached maturity. 61.3% of such deposits were made with banks in July of the previous year.

The percentage of other savings has begun to rise as the tenure part is declining. The percentage of ordinary savings in bank deposits climbed to 30.3 percent this year from just 26.7 percent in July of last year.

A lack of liquidity last year led banks to prioritize fixed deposits as a way to boost deposits. As a result of the decline in deposit interest rates, the previously growing portion of fixed deposits has begun to decline since last year. The Nepal Bankers Association made the decision to dispense with the agreement on deposit interest rate determination from July of last year and fix the interest rate unilaterally when liquidity began to decline. Following that, in July of this year, the interest rate on the deposit, which had been declining, dropped to about 5%.

When there is a shortage of liquidity in the bank, greater interest rates are typically offered in term programs to encourage deposits, according to spokeswoman Ramu Poudel of Rashtra Bank. "If banks lack liquidity, they increase long-term deposits by paying more interest," he stated.

The maximum interest rate that banks can provide on fixed deposits is five percentage points higher than the minimum interest rate on regular savings, according the National Bank's guidelines on interest rate determination. A clause states that, with the exception of call deposits, the gap between the highest and minimum interest rates offered in all categories of local currency deposit accounts cannot be greater than five percentage points.

A banker stated that the deposit ratio between banks will rise as a result of low liquidity. The lender responded, "There is no need to take fixed deposits by paying more interest because there is no liquidity management stress for banks now." He claimed that the share of tenure has somewhat increased as a result of the unhealthy competition in deposits and the lack of liquidity.

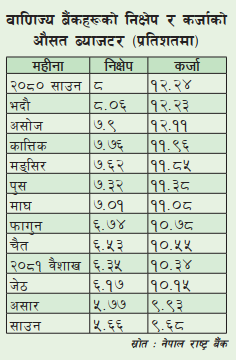

The loan interest rate is falling in tandem with the base rate following the banks' reduction of the interest rate on deposits. Commercial banks' average base rate dropped from 10.11 percent in 2080 to 7.61 percent in 2081. The base rate has dropped, and bank lending interest rates have followed suit.

According to the National Bank, the average interest rate on loans from commercial banks dropped from 12.24 percent in July 2080 to 9.68 percent in July 2081. In the meantime, development banks' average interest rates have gone from 13.88 to 11.07 percent, while financing businesses' average interest rates have gone from 14.66 to 12.32 percent.